nj bait tax form

This act creates an election for pass-through entities PTEs to pay New Jersey income. This change does not affect TY 2020.

New Jersey Pass Through Business Alternative Income Tax Act Curchin Nj Cpa

The BAIT for New Jersey S Corporations continues to be limited to New Jersey-sourced income.

. An electing business must file an annual tax return Form PTE-100 to calculate its New Jersey source income and the resulting tax. For tax year 2021 NJ addressed many of these issues by revising the BAIT form calculations to be more in line with the income that will be flowing out to the partners. You can only use the NJ Pass-Through Business Alternative Income Tax PTE Online Filing and Payments system if your business is.

5675 for distributive proceeds below 250000. Each electing pass-through entity must submit form PTE-100 a PTE-K1 for every owner and form NJ-NR-A if the pass-through entity is conducting business both inside and. Log in below using the first prompt.

New Jersey has enacted the Pass-Through Business Alternative Tax Act BAIT. The PTEs distributive income is subject to tax at the following graduated rates for purposes of computing the BAIT. Bracket Changes As a result of the amendments the BAIT increases to the.

February 23 2022 226 AM. Out-Of-State Winery License For Direct Ship Wine Sales to New Jersey. The NJ BAIT tax will be reported on a separate schedule called PTE K-1 Members Share of Tax Schedule.

Your PIN is printed. Tax year for Form. However my understanding is that the NJ BAIT payment is deductible as a business expense of the PTE in my case an S-Corp.

Pass-Through Business Alternative Income Tax Act. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT.

Thanks very much for your reply. In addition for Tax Year 2021 an S corporation has the option to use a three-factor allocation formula on NJ-NR-A for purposes of the BAIT. File Pay and Access Past Filings and Payments.

With their New Jersey Gross Income Tax or Corporation Business Tax return to claim credit for their share of the tax paid. Pass-Through Business Alternative Income Tax Act. The NJ BAIT tax payment is made by SCorp after registering at NJ Pass Thru.

See the instructions for the appropriate return. New Jersey enacted the Business Alternative. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns.

Assume a PTE filed its 2021 BAIT return on. This change does not affect TY 2020. PL2019 c320 enacted the Pass-Through.

For the amount of tax paid on its share of distributive. Landfill Closure and Contingency Tax. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax.

However it is not reported on the 1120-S. Enter your taxpayer identification number and Personal Identification Number PIN. On the bottom of the form is a box for the members share of business.

Mine is single member SCorp.

Directives And Procedures Nj Ag 2014 Prison Legal News

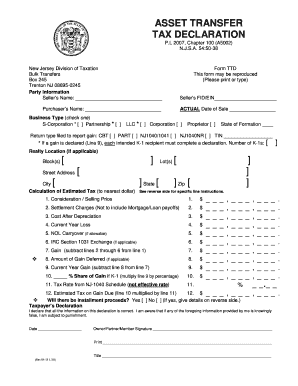

Nj Form Tax Fill Out And Sign Printable Pdf Template Signnow

New Jersey Enacts Elective Pass Through Entity Business Alternative Income Tax Marks Paneth

Elective Business Alternative Income Tax For Pass Through Entities To Address Federal Limitation On State And Local Deduction Wiss Company Llp

Turbotax Sued By Feds Over Claims Of Free Tax Filing Offerings Nj Com

The Pass Through Entity Tax A Salt Limitation Workaround

Business Activity Code For Taxes Fundsnet

Nj Business Alternative Income Tax Bait Law Change Sax Llp Advisory Audit And Accounting

The Pass Through Entity Workaround To Beat The Salt Limitation Certified Tax Coach

New Jersey Pass Through Business Alternative Income Tax Bait Updates Marcum Llp Accountants And Advisors

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

New Jersey Passes Bill To Correct Issues Arising From The Implementation Of The Nj Business Alternative Income Tax Marcum Llp Accountants And Advisors

New Jersey Income Tax Return Fill Online Printable Fillable Blank Pdffiller

What Is The W 9 Tax Form And How Do You Fill It Out

Livingston Accountant Addresses New Jersey Business Alternative Income Tax Livingston Nj News Tapinto

Form Nj 1040 Income Tax Resident Return Youtube

Nj Bait Deduction On Form 1040

Nj Fishing Community Says Covid Aid Helped Keep Them Afloat Nbc New York